Spanish Warehouse Market is in High Growth & Options

In the past ten years, the number of warehouses in Spain has grown significantly. According to CBRE, Spain saw a record take-up of logistics space in 2023, with over 2.8 million square meters ([CBRE Report]. This substantial growth reflects the increasing demand for storage and distribution facilities.

The number of employees and businesses utilizing warehouses in Spain has paralleled this expansion. In 2020, the Spanish warehousing and logistics sector employed over 1 million of people, annual revenue of the sector amounts to €101 billion, there is a significant concentration of businesses, with approximately 218,000 companies operating in the sector, logistics sector accounts for 6.9% of Spain’s GDP. In 2022, this percentage increases to 10% when including logistics activities performed by industrial, commercial, and service companies.. ([ICEX]

Where is the Best Location for Your Spanish Warehouse?

Choosing the right location for your warehouse in Spain can make the difference between success and failure. The best location depends on several factors:

- Inbound Shipping Location: Ideal for minimizing inbound freight costs.

- Centralized Location: Helps reduce overall outbound shipping times and costs to customers.

- Proximity to Business: Whether the warehouse needs to be near your business can be a personal preference.

- Multiple Locations: Most small and growing companies do not require multiple locations initially.

Consider the following factors when choosing your Spanish warehouse location:

- Order Volume Concentrations: Determine where the highest concentration of your orders will be shipped.

- Shipping Costs and Times: Central warehouse locations can minimize average shipping costs and delivery times.

- Inbound Freight Costs: Choose a warehouse near a port if your business is concerned about inbound freight costs.

- Staff Interaction and Accountability: For quality checks and building close relationships, select a warehouse close to your staff.

- Regional Taxes: Choose a warehouse that aligns with your tax needs based on the specific region in Spain.

How to Choose the Best Location for your Warehouse in Spain

Here are the key criteria for selecting the best warehouse location:

- Monthly Warehouse Fees: Avoid locations with high pallet storage or monthly warehousing costs that could negate your profit. Some regions in Spain are more expensive than others, and monthly warehouse fees will constitute a significant portion of your expenses.

- Labor Availability & Costs: Finding skilled labor at a reasonable cost is crucial for maintaining low expenses.

- Transportation Costs: Connectivity, public transport availability, traffic speed, and road conditions affect transportation costs.

- Proximity to Transportation: Being close to ports, airports, and highways is essential for order fulfillment and logistics.

- Proximity to Sales Markets: Warehouses should be close to your customer base. For example, if you serve customers mainly in Madrid, having a warehouse there makes sense.

- Proximity to Suppliers: Being close to your supplier reduces transportation costs and improves supply chain efficiency.

- Foreign Trade Zones: If you deal with goods produced outside of Spain, using a foreign trade zone warehouse can help eliminate taxes and tariffs.

- Environmental Factors and Disaster Contingency Planning: Consider weather and geographical restrictions, such as avoiding areas prone to heavy snowfall or floods.

The Most Important Information You Should Consider When Selecting Warehousing in Spain

When selecting a warehouse in Spain, consider:

- Customer retention rate

- Order accuracy rate

- Inventory accuracy rate

- Shipping accuracy rate

- Years in business

- Number of customers

- Annual order volume

Benefits of Working with Spanish Warehouses for Global Companies

Global companies can also benefit from using Spanish warehouses:

- Reduced Costs and Times: Lower shipping costs and delivery times improve customer service levels and efficiency.

- Diversity: Multiple fulfillment centers reduce the risk of supply chain disruptions.

- Fulfill Spanish Orders: Faster delivery times for Spanish customers improve service quality.

What Services do Spanish Warehouses Provide?

Spanish warehouses offer various services:

- Inventory Control: Reduces human error in handling packages.

- Cross Docking: Breaks down products into multiple shipments for accurate delivery.

- Fulfillment and Pick and Pack Services: Covers B2C, B2B, and e-commerce order fulfillment.

- Transportation and Transloading: Allows tracking of goods and efficient transfer between transportation modes.

Top Locations for Warehousing in Spain

Popular warehousing locations in Spain include:

- Warehouse in Madrid: A central hub for logistics and distribution.

- Warehouse in Barcelona: Strategic location near the Mediterranean.

- Warehouse in Valencia: Key port city with access to Mediterranean trade routes.

- Warehouse in Bilbao: Important northern distribution point.

- Warehouse in Cordoba: Main city in the south with access to the Mediterranean, near Algeciras most efficient port of Europe, TOP 10 in the world. (The CPPI 2023: Global Ranking of Container Port)

How Much are Warehouses in Spain?

The average costs of fulfillment services fees and rates in Spain, based on our yearly survey, are:

- Set-Up Costs: €300-€550 or €130-€400 for web integration

- Inbound Shipping: Varies by carrier contract

- Receiving Fee: €35 per hour or €300 per 20’ container

- Storage Fee: €15 per pallet or €0.45 per cubic foot

- Fulfillment Fee: €2.90 per single item or €4.00 for B2B order

- Box Fee: €0.45 to €1.50 on average, €0.75 per box

- Order Inserts: €0.04 per label or €0.20 per insert

- Outbound Shipping: €0.45-€1.90 per order

- Returns: €3.00 per order

- Kitting: €0.23-€0.60 per unit or €30.75 per hour

- Account Management: €28-€450 per month

- Call Center: €1.30 per minute

Special Considerations for Global Companies Expanding into the Use of Spanish Warehousing

For non-Spain-based companies looking to expand into the Spanish market, finding a warehouse in Spain can help overcome logistical challenges and improve customer service. This step can lead to sustainable growth and increased profitability.

Consider these factors:

- 1. Why should you enter the Spanish market?

- 2. What regulatory hurdles must be overcome?

- 3. Why should you utilize a freight forwarding service?

- 4. Where is the best location for your warehouse?

- 5. When should you start looking for a Spanish warehouse company?

Armed with this knowledge, you can make an informed decision and find the best fulfillment provider for your needs.

Why Should You Enter the Spanish Market?

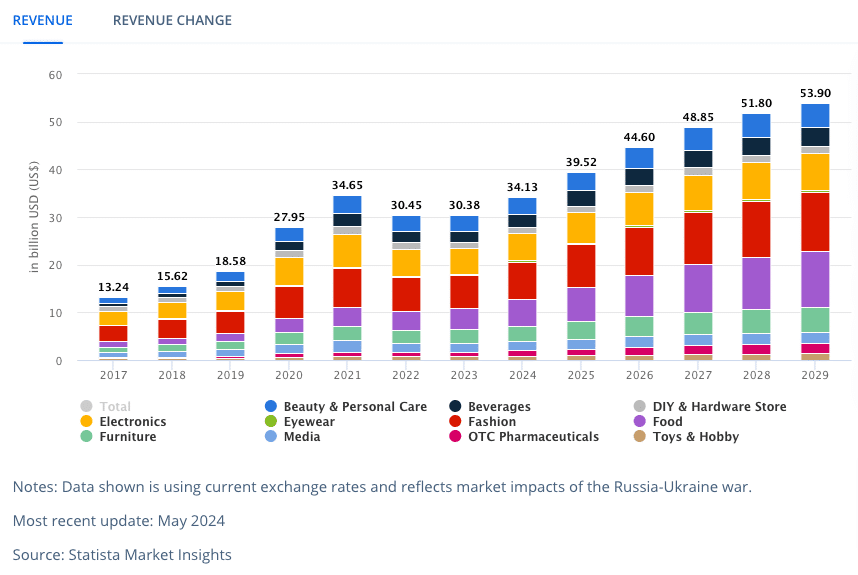

Spain’s e-commerce market is rapidly growing, with a 20% year-over-year growth rate in 2021 ([Statista]). Spain’s strategic location as a gateway to Europe, Latin America, and North Africa makes it an attractive hub for international businesses.

What Regulatory Hurdles Must Be Overcome?

- Spanish Citizenship: Not required to sell products in Spain.

- Spanish Entity: Establishing a physical presence in Spain can build consumer trust.

- Tax Ramifications: Sales tax collection is required, and registration with the Spanish Tax Agency (Agencia Tributaria) is necessary.

- Importing Products: Enlist a Spanish customs broker, declare an Importer of Record (IOR), and ensure all duties are paid.

- Spanish Website: Enhances sales and marketing effectiveness.

- Spanish Bank Account: Builds consumer trust and facilitates transactions.

Why Should You Utilize a Freight Forwarding Service?

Freight forwarding companies handle logistics, documentation, and transport, ensuring efficient delivery of your goods.

Comparative Analysis of Warehousing and Fulfillment Services Across Europe countries

Spain warehousing

Demand and Pricing:

In Spain, the warehousing sector has been experiencing significant growth, driven by the surge in e-commerce and the need for more efficient logistics solutions. According to the Q1 2024 logistics report, Spain reported a significant uptake in logistics space, particularly in Madrid and Barcelona, with rental prices averaging around €5.25 per square meter per month. This increase is attributed to the heightened demand for last-mile delivery and the strategic positioning of Spain as a logistics hub within Southern Europe.

Germany warehousing

Demand and Pricing:

Germany stands as one of the most developed logistics markets in Europe, with high demand for warehousing space driven by its strong industrial base and central location within the continent. Warehouse rents in major cities like Berlin and Hamburg average between €6.50 and €7.00 per square meter per month. The demand for modern, automated warehouses is particularly high, with a focus on sustainability and energy efficiency.

France warehousing

Demand and Pricing:

France’s warehousing market is characterized by its robust e-commerce sector, which has driven demand for fulfillment centers, especially around Paris. The average rental price for warehouse space in Paris is approximately €6.00 per square meter per month. The country’s strategic position and advanced infrastructure make it a key player in European logistics, with growing interest in regions like Lyon and Marseille for their logistics potential

Netherlands

Demand and Pricing:

The Netherlands is renowned for its advanced logistics infrastructure, centered around the Port of Rotterdam, Europe’s largest port. Warehouse rental prices here are among the highest in Europe, averaging €7.50 per square meter per month. The high demand is fueled by the country’s strategic position as a gateway to Europe and its cutting-edge logistics facilities, which support efficient distribution across the continent.

United Kingdom

Demand and Pricing:

The UK’s logistics market, particularly around London, is one of the most expensive in Europe due to high demand and limited space. Warehouse rents in London can reach up to €9.00 per square meter per month. The Brexit effect has also influenced warehousing demand, leading to an increase in stockpiling and demand for storage space. Additionally, the growth of e-commerce has significantly boosted the need for fulfillment centers across the UK

Summary

In summary, while Spain offers competitive pricing and strategic advantages within Southern Europe, countries like Germany and the Netherlands lead in logistics efficiency and infrastructure. France and the UK also present significant opportunities but come with higher costs. Spain’s growing market and favorable conditions make it an attractive and cheapest option for businesses looking to establish or expand their warehousing and fulfillment operations in Europe.